Commercial Auto Insurance

Protection to help keep your business operating smoothly.

We compare coverage options from our trusted partners.

What is Commercial Auto Insurance?

Protection for Business

Vehicles

Vehicles

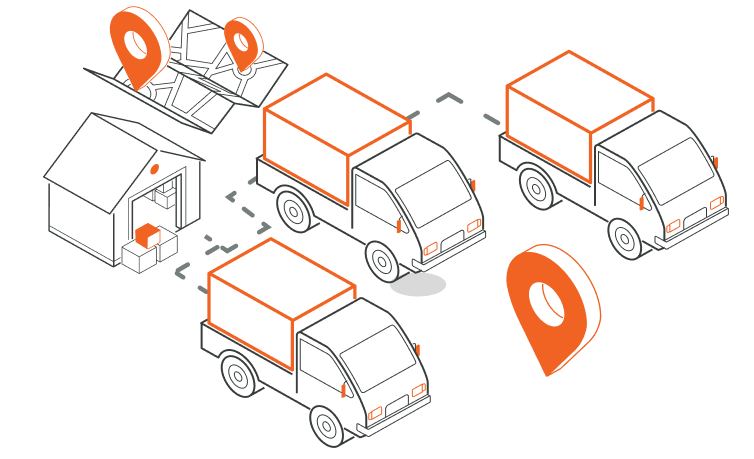

Commercial auto insurance helps keep business vehicles and their employees protected while on the road.

Protection for Personal Vehicles Used for Business

In some situations, personal auto insurance will not cover you if you're using your vehicle for business purposes. You may need commercial auto insurance too.

Customize Your

Coverages

Coverages

We can help you find commercial auto coverage that meets yours or your business' needs.

What Types of Vehicles are Covered?

Many types of vehicles can be covered if they are used for business purposes.

Vans

Cars

Box Trucks

Food Trucks

Trailers

Refrigerated Trucks

SUV

Commercial Auto Coverages

What's Covered

Optional

Roadside Assistance

New Vehicle Replacement Cost

Towing

Rental Reimbursement

Lease Coverage

Personal Protection Coverage

Rental Reimbursement

Factors That Can Potentially

Impact Your Rate

Safety Devices

You may be able to minimize your rate by equipping your vehicle or fleet with safety devices that help decrease accidents and chances of theft.

Coverage Limits

Your commercial auto insurance rates depend on the amount of coverage you elect. Most states have minimum requirements drivers must meet or exceed.

Credit History

Credit history can also impact your rate. Drivers with better credit may pay less while drivers with poor credit may pay more.

Driving Record

Drivers who have prior accidents, traffic tickets, or moving violations may appear riskier to auto insurers. A clean driving record may help get you a lower rate.

Vehicle Value

The type of vehicle and miles driven may impact your premium cost. Each company weighs these factors differently which is why comparison shopping can be helpful.

Location

Where you live and drive factors into calculating your premium. If your business is in an urban area with heavier traffic and higher crime rates, you may pay more than someone who lives in a rural area with less traffic and lower crime rates.

New to Commercial Auto Insurance?

Here is What to Expect

Do I need Commercial Auto Insurance?

A commercial auto insurance policy may be required if a vehicle is used for business activities or for the operator's profession, aside from commuting.

Each situation is unique, which is why discussing your vehicle use with a licensed agent can be helpful in determining what kind of coverage you need.

Discounts and

Savings

Savings

We'll make sure you get every discount for which you qualify. Common commercial auto insurance discounts include:

- Multi-car

- Anti-theft

- Safety devices

- Marital status

- Good driver

- And more

How Much does Commercial Auto Cost?

Rates vary due to multiple factors. The number of vehicles to insure, vehicle use, and coverage limits are all factors that impact cost. Our licensed insurance agents can help you shop around for quotes and help you find a policy that makes sense for business.

Our licensed insurance agents will discuss available options and discounts during your commercial auto quote.

Commercial Auto

Insurance FAQ

Insurance FAQ

Do I need commercial auto insurance?

A commercial auto insurance policy may be required if a vehicle is used for business activities or for the operator's profession, aside from commuting.

Each situation is unique, which is why discussing your vehicle use with a licensed agent can be helpful in determining what kind of coverage you need.

Would commercial auto insurance be more expensive than auto insurance?

Every situation is unique. Premium cost depends on many factors, and shopping around for policies may be helpful. Our licensed insurance agents can help you find insurance coverage to meet your needs and budget.

What is difference between commercial and business auto insurance?

Businesses may require commercial auto insurance for their vehicles. They may also need other types of business insurance such as General Liability or Workers Compensation. Laws and regulation vary by state, jurisdiction, and industry. If you want assistance in figuring out what your business requires, contact our licensed agents and we'd be happy to discuss your situation.

Availability in my state?

We shop and quote commercial auto for businesses in Illinois, Indiana, Pennsylvania, and Texas. More states will be available in the future.

Protecting Customers Since 1980

Read what customers are saying about our service.

I spoke with Crystal Thomas today and I was very very pleased with the service she provided. She needs a raise at this point. Loved the experience and went above and beyond to help with further questions that had nothing to do with the point of the call.

Jerri B.

Fastest and easiest platform to purchase insurance. Honest up front about all charges and very nice and friendly when it came to customer service.I would recommend this agency to everyone needing a no hassle policy.Thanks again guys, look forward to a long and trusting relationship

Oscar E.

The service was top tier. Nick was very helpful and informative. Wish everyone had great customers service like he did. Thank you again 😊

Maria T.

The service was top tier. Nick was very helpful and informative. Wish everyone had great customers service like he did. Thank you again

Jacobi D.